Can a trust be created under Luxembourg law?

A trust cannot be established under Luxembourg domestic law, as the concept of “trust” does not exist as a legal institution in Luxembourg civil law. Luxembourg is a civil law jurisdiction and has not enacted its own trust legislation.

The Hague Convention on Trust recognised since 2004 in Luxembourg

Luxembourg however has ratified the Hague Convention of 1 July 1985 on the Law Applicable to Trusts and on their Recognition (in force in Luxembourg since 2004). Such law is used in various occasion (securitisation, fiducie, etc)

As a result, foreign trusts validly constituted under the laws of a common law jurisdiction (e.g., England, Jersey, Guernsey) are recognised in Luxembourg, including the rights and obligations of trustees and beneficiaries.

The Alternatives

Company Structure:

Promoters and families may choose to setup :

Private Wealth Management Company (to hold and managed a portfolio of securities) Or

SOPARFI (to hold and manage participations, real estate, intellectual property rights, etc)

Or

Special Limited Partnership (to hold any kind of assets and transfer it to the next generation)

Or

Luxembourg Fiducie (Law 27 July 2003)

Luxembourg introduced the concept of fiducie, which is somewhat similar to a trust, but it is strictly reserved for regulated financial institutions and cannot really be used by private individuals for personal estate planning

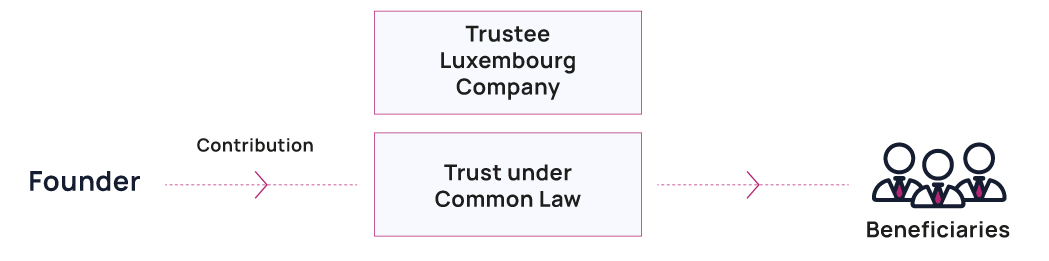

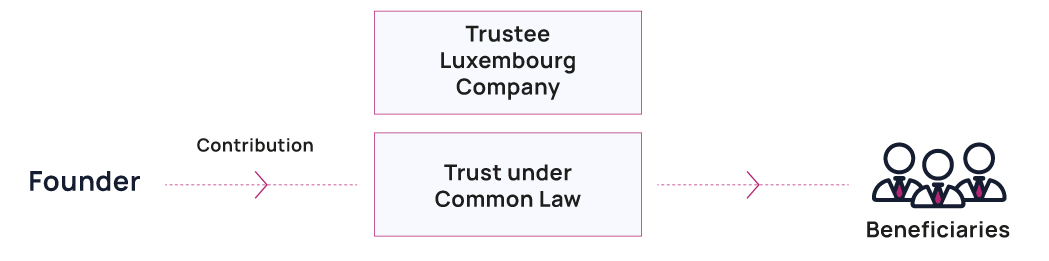

Solution for structuring a Trust in Luxembourg:

A trust can be setup under the common law (England, channel island or any other legislation)

The trustee can be a Luxembourg company.

The assets are held “off balance sheet” and managed for and on behalf of the beneficiaries. (charity, family members, etc)

The Trust is recognized and enforceable in Luxembourg.